t’s the age-old question in real estate: what makes the most sense—buying or selling first?

“Traditionally, the answer depended on your comfort level with risk and your financial flexibility,” says Broker Clinton Howell.

If you are someone who is risk-averse and 100% need the funds from your sale in order to purchase your next property, selling first was typically the safer bet. If you knew that your property had already sold, it gave you more leverage when negotiating your purchase.

But if you’re confident in your financing and looking for something specific, buying first made sense, especially if you didn’t want to rush your purchase.

Current conditions

“Today’s market, however, is more complex. While Burlington remains in-demand, we're seeing longer days on market and increased price sensitivity. Homes that are priced well still move quickly, but buyers are more selective and less likely to accommodate purchase conditions,” says Clinton.

His advice:

- If you need to sell in order to buy, sell first unless you can comfortably carry both properties. That said, the Sale of Property condition has become more relevant again in this shifting market. For buyers who aren’t ready to take the leap without selling first, this clause can offer essential protection, especially in a buyer-friendly environment.

- If you’re upsizing and worried about missing the right home, together you can explore a longer closing date on your sale to buy you some time.

The following changes are necessary right now in particular, because:

- Homes are taking longer to sell.

- Conditional offers are harder to negotiate in a competitive seller’s market environment; current conditions are more favourable for buyers.

- Even though interest rates have come down somewhat in recent months, they are still much higher than they were during the pandemic and financing is more expensive, making it riskier to carry two homes.

Buying first makes sense when:

- You’re downsizing and have significant equity.

- You can qualify for bridge financing or hold two mortgages temporarily.

- You’re looking for something very specific or rare.

- You’re moving to a less competitive or more affordable market.

- Have a home that’s likely to sell quickly.

“Confidence and motivation are big components of buying first. Some properties are in high demand and predictably easier to sell, making it easier to consider buying before listing,” says the REALTORⓇ.

Selling first makes sense when:

- You need the funds from the sale to buy.

- You don’t want the pressure of owning two homes.

- You’re in a more saturated or slower-selling segment.

- You’re okay with renting temporarily or have flexible housing options.

- You want to sell your home faster with less financial stress.

Buying first: Advantages and disadvantages

“Buying first gives you the luxury of time and selection. You’re not rushed, and you can wait for the perfect property to come along,” says Clinton. “However, this approach comes with some important considerations.”

Advantages: You control your next move, and there is less risk of ending up somewhere you don’t want. You’ll have time to look carefully and secure a home that checks all your boxes. Your move can be more seamless with less time spent in temporary housing. Lastly, in a rising market, buying first may help you avoid paying more later.

Disadvantages: There is the risk of owning two homes—and having two mortgages. You may be stuck paying two mortgages if your home doesn’t sell quickly. If your home isn’t selling quickly, you may have to lower your price. Once you buy, the pressure to sell ramps up. If the market slows or your home takes time to sell, stress and costs can pile up. Financing might also be trickier to arrange without a firm sale in place.

Selling first: Advantages and disadvantages

“Selling your home first can provide a sense of financial stability and clarity as you move into the buying process. It’s the traditional route and often preferred by homeowners who want to know exactly how much equity they’re working with before purchasing their next property,” says the REALTORⓇ.

Advantages: You know exactly what you have to work with budget-wise. There is no risk of having to carry two properties. You’re not juggling two mortgages or feeling rushed to sell to avoid financial strain. You’re also in a stronger negotiating position when you’re ready to buy. You won’t need to make an offer conditional on the sale of your current home, making your offer stronger in a competitive market.

Disadvantages: You might feel pressure to buy quickly—or rent in the interim. If you sell before securing a new home, you may feel pressure to buy quickly—or risk needing temporary accommodations. Limited inventory could make it hard to find the right home right away.

Other key takeaways:

- Closing dates matter: Strategic timing can ease stress. “We often aim for a longer closing on your sale and a shorter closing on your purchase to close the gap,” says Clinton.

- Bridge financing isn’t always guaranteed: Talk to your lender early to understand your options.

- Emotional toll: Moving twice (e.g. renting between homes) might not sound bad, but it can be exhausting, especially with kids or pets.

- Buyers and sellers aren’t always in the same type of market: If you’re buying into a more competitive market segment but selling a higher-end property, your timelines may not match up. You could sell fast but struggle to find your next home, or vice versa.

- Communication is everything: Whether you’re buying or selling first, everyone on your team—REALTORⓇ, mortgage broker, lawyer, and even movers—should be aligned with your timeline. Good planning is the difference between a smooth experience and a stressful one.

Says Clinton, “Every situation is different and that’s why working with a local, experienced REALTORⓇ matters. We don’t just help you buy and sell; we help you time your move so that everything lines up as smoothly as possible.”

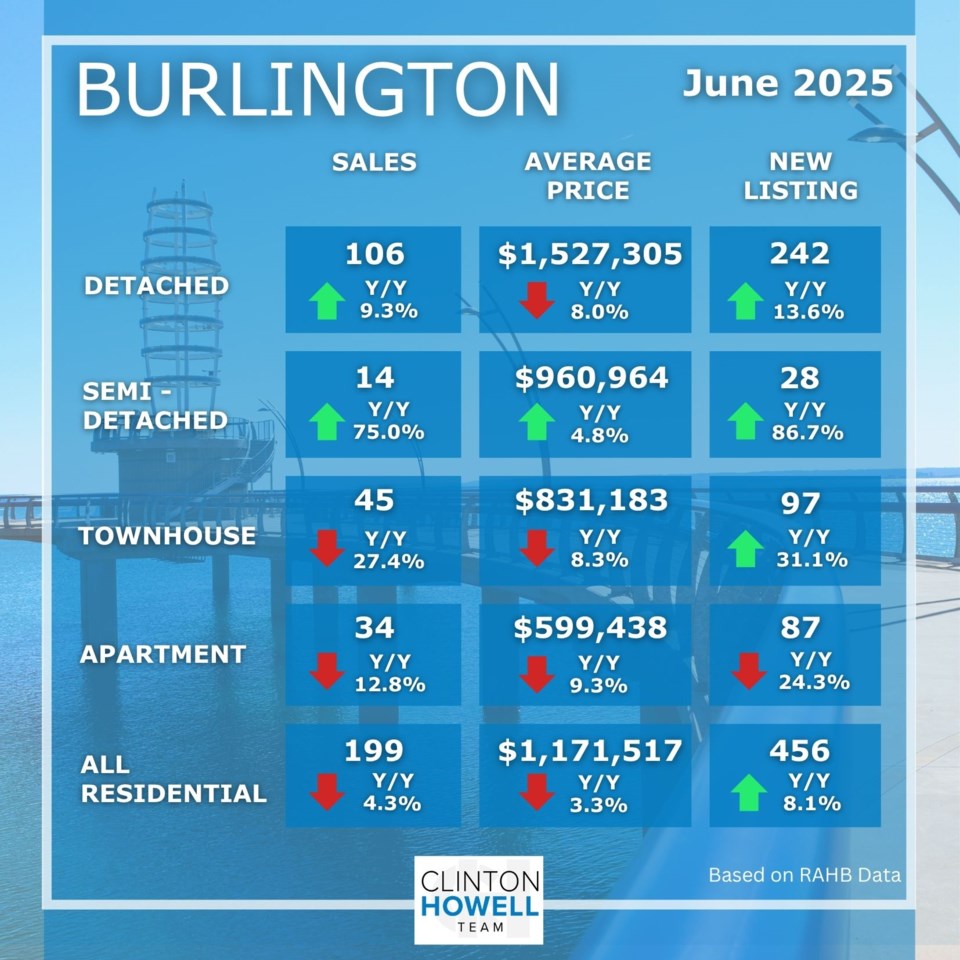

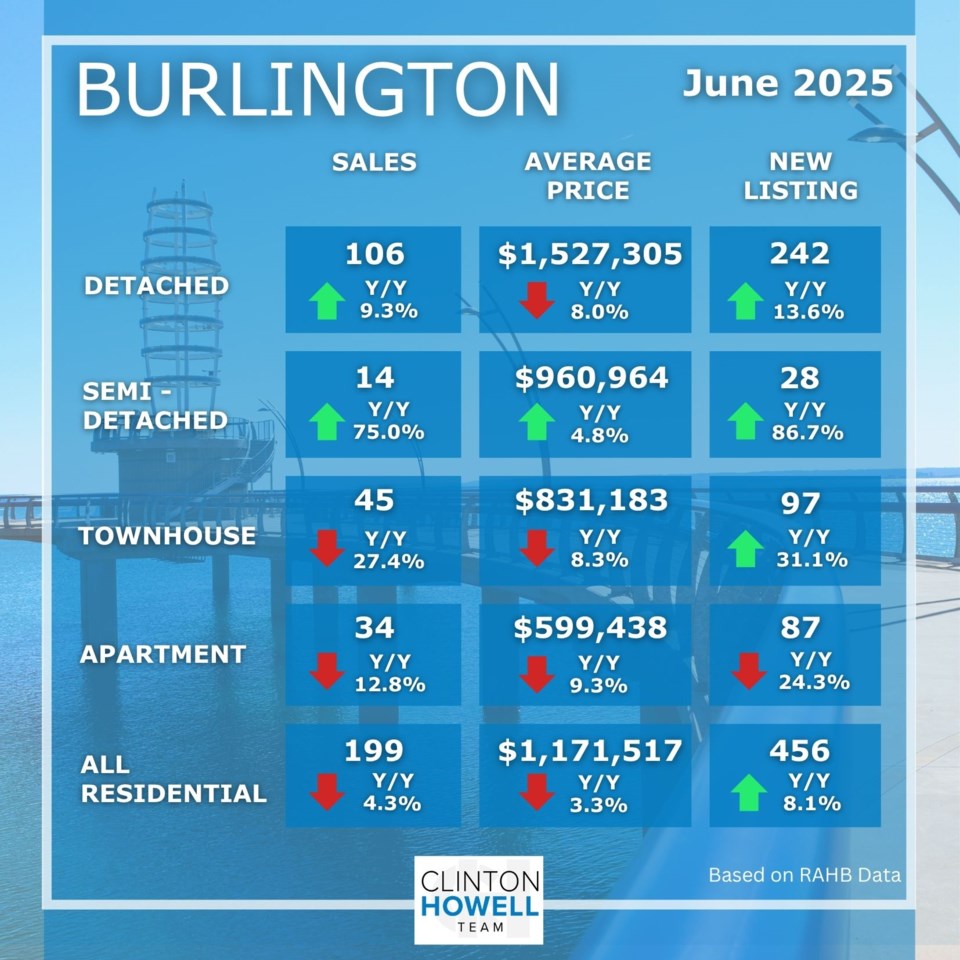

JUNE 2025 update: Burlington

Broker Clinton Howell has helped hundreds of buyers purchase their dream home in Burlington, Waterdown, Ancaster and beyond, guiding them each step of the way.

To view the latest listings, visit RE/MAX Escarpment Realty or call 905-537-2246.

Watch Howell’s weekly real estate market updates on YouTube.

You can also follow him on LinkedIn, Instagram, and Facebook.